CA FL-630 2017-2024 free printable template

Show details

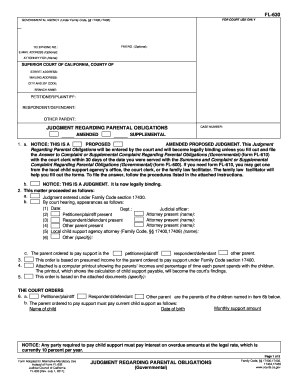

FL-630 FOR COURT USE ONLY GOVERNMENTAL AGENCY under Family Code 17400 17406 TELEPHONE NO. FAX NO. E-MAIL ADDRESS ATTORNEY FOR name SUPERIOR COURT OF CALIFORNIA COUNTY OF STREET ADDRESS CITY AND ZIP CODE BRANCH NAME PETITIONER/PLAINTIFF RESPONDENT/DEFENDANT OTHER PARENT/PARTY JUDGMENT REGARDING PARENTAL OBLIGATIONS AMENDED CASE NUMBER SUPPLEMENTAL 1. Page 1 of 3 Form Adopted for Alternative Mandatory Use Instead of Form FL-692 Judicial Council of California FL-630 Rev. January 1 2017...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fl630 parental 2017-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fl630 parental 2017-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fl630 parental online

To use the professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fl 630 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

CA FL-630 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fl630 parental 2017-2024 form

How to fill out fl 630:

01

Start by opening the fl 630 form.

02

Fill in your personal information, such as your name, address, and contact details.

03

Provide any necessary identification information, such as your social security number or driver's license number.

04

Indicate the reason for filling out the form, whether it's for a specific government program or for personal records.

05

If applicable, provide any supporting documents or evidence that may be required.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form before submitting it to the appropriate recipient.

Who needs fl 630:

01

Individuals who are applying for a government program that requires the submission of fl 630.

02

Businesses or organizations that need to maintain detailed records of their financial transactions.

03

Individuals or families who want to track their personal income and expenses for budgeting purposes.

Fill ca fl 630 : Try Risk Free

People Also Ask about fl630 parental

What is a notice of entry of judgment?

What is FL 600 form?

What is FL 610?

What is a FL 155 form?

What is Form FL 342?

What is FL 630 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fl 630?

There doesn't seem to be a specific meaning or reference to "fl 630" that can be identified. It may be a mistake, a coding designation, or a term used in a specific context that is not commonly known. If there is more context or additional information provided, it would be helpful in providing a more accurate answer.

Who is required to file fl 630?

The state of California requires certain employers to file Form FL-630, also known as the Report of Independent Contractor(s), if they have paid $600 or more in a calendar year to an individual or business that is not classified as an employee. This form is used to report payments made to independent contractors for services provided.

What is the purpose of fl 630?

FL 630 typically refers to Flight Level 630, which is an altitude measurement in aviation. Flight levels are used to standardize and control the vertical separation of aircraft in the airspace. FL 630 indicates that the airplane or aircraft is flying at an altitude of 63,000 feet above mean sea level. The purpose of FL 630, like any other flight level, is to facilitate safe and efficient air traffic management by ensuring proper vertical spacing between aircraft to prevent mid-air collisions and maintain traffic flow.

What is the penalty for the late filing of fl 630?

The penalty for late filing of form FL 630 can vary depending on the specific circumstances and jurisdiction. It is recommended to consult with a legal professional or the relevant governing authority to obtain accurate and up-to-date information on the penalty associated with late filing of FL 630 in your particular situation.

How to fill out fl 630?

FL-630 is a form used in California for the Petition for Temporary Restraining Order. To fill out this form, you can follow these steps:

1. Obtain the FL-630 form: You can download the form from the California Courts' website or obtain a physical copy from the court clerk's office.

2. Case information: Begin by entering the court's name, case number, division, and the name of the protected person in the designated spaces at the top of the form.

3. Protected person information: Fill in the personal information of the protected person, including their full name, date of birth, and contact information like address, phone number, and email address.

4. Restrained person information: Include the name(s) of the person(s) you seek to restrain.

5. Relationship between protected person and restrained person: Provide details about the relationship between the protected person and the restrained person, such as spouse, cohabitant, parent, child, etc.

6. Description of abuse or harassment: Describe the specific incidents of abuse or harassment that support your request for a restraining order. Be as detailed as possible, providing dates, times, locations, and any witnesses or evidence.

7. Protected persons' statement: The protected person should explain why they need the restraining order and what relief they are seeking, such as no-contact orders, move-out orders, child custody orders, etc.

8. Additional orders: If there are any additional specific orders requested, such as firearms restrictions or pet protection orders, they should be listed in this section.

9. Temporary restraining order information: Provide information about any existing temporary restraining orders related to the case, including their expiration dates and whether you are requesting an extension.

10. Other court orders: Indicate if there are any other pending court orders related to the case.

11. Declaration and signature: The protected person needs to sign and date the form, declaring under penalty of perjury that the information provided is true and correct.

12. Proof of service: After filing the form with the court clerk, you will need to serve a copy on the restrained person. Fill out the proof of service section once you have completed the service.

It is essential to consult with an attorney or research the specific requirements and procedures in your jurisdiction, as this form may have variations depending on the court you are filing in.

What information must be reported on fl 630?

FL 630 refers to the Corporation Income Tax Return that is typically filed by corporations. The specific information that must be reported on this form may vary depending on the tax jurisdiction, but generally, the following information is required:

1. Identification Details: This includes the corporation's legal name, Employer Identification Number (EIN), mailing address, and the tax year being reported.

2. Income Information: Corporations are required to report all sources of income earned during the tax year. This includes revenue from sales, services, investments, and any other income-generating activities.

3. Deductions and Expenses: Corporations can deduct certain expenses incurred for business purposes. These may include costs related to salaries and wages, rent or lease payments, insurance, utilities, and depreciation of assets.

4. Credits and Exemptions: Corporations may be eligible for certain tax credits or exemptions that can reduce their overall tax liability. These can include research and development credits, energy-related credits, or credits for investing in certain disadvantaged areas.

5. Net Income or Loss: The corporation must calculate its net income or loss for the tax year based on the income and expense figures reported.

6. Tax Liability: The corporation needs to determine its total tax liability based on the net income or loss. This is usually calculated by applying the applicable corporate tax rate to the taxable income.

7. Payments and Refunds: The corporation needs to report any estimated tax payments made during the tax year. Additionally, if there is an overpayment of taxes, the corporation may be entitled to a refund.

8. Required Disclosures: The corporation must disclose any additional information or disclosures required by the tax jurisdiction. This could include specific attachments or schedules related to certain types of income, deductions, or transactions.

It is important to note that the specific requirements for reporting on FL 630 may differ based on the country, state, or local tax regulations. It is advisable to consult with a tax professional or review the specific tax instructions provided by the relevant tax authority to ensure accurate reporting.

How can I edit fl630 parental from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your fl 630 form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit judgment regarding form online?

With pdfFiller, it's easy to make changes. Open your regarding parental obligations in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit fl 630 form on an Android device?

You can make any changes to PDF files, such as ca regarding parental obligations form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your fl630 parental 2017-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Judgment Regarding Form is not the form you're looking for?Search for another form here.

Keywords relevant to fl630 judgment parental obligations form

Related to fl630 judgment regarding parental

If you believe that this page should be taken down, please follow our DMCA take down process

here

.